Irs tax refund interest calculator

100 Accurate Calculations Guaranteed. The interest calculation is initialized with the amount due of.

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

The IRS charges a penalty for various reasons including if you dont.

. The agency tacks on interest if it. Up to 10 cash back Use our tax refund calculator to find out if you can expect a refund for 2021 taxes filed in 2022. Trial calculations for tax owed per return over 750 and under 20000.

File your tax return on time. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. The IRS paid 136 billion in interest last year on the refunds for.

Approval and loan amount. Use The Tax Calculator To Estimate Your Tax Refund Or The Amount You May Owe The IRS. Interest principal interest rate term When more complicated frequencies of applying interest are involved such.

It is not your tax refund. Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations. IR-2020-183 August 18 2020 WASHINGTON This week the Treasury Department and the Internal Revenue Service will send interest payments to about 139.

This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. Upgrade to two years for 90. The IRS is sending taxpayers a.

The regular April 15 due date for filing returns and paying income taxes was postponed to. Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. Upgrade to two years for 90.

When will I get my 2021 tax refund. Got My Refund With VaroTT 224 WITH FEESI have varo Im hoping mines come soon. This is updated quarterly.

Our IRS Penalty Interest calculator is 100. Call the phone number listed on the top right-hand side of the notice. Taxpayers who dont meet their tax obligations may owe a penalty.

So for a 1000 refund you would get around 333 of interest for every month or 40 per annum your refund is delayed for 45 days or more. Contact your local Taxpayer. This is an optional tax refund-related loan from MetaBank NA.

Most IRS tax refunds are. It is mainly intended for residents of the US. Got My Refund With VaroTT 224 WITH FEES.

IRS sets and publishes current and prior years interest rates quarterly for individuals and businesses to calculate interest on underpayment and overpayment balances. Our IRS Penalty Interest calculator is 100. Trial calculations for tax owed per return over 750 and under 20000.

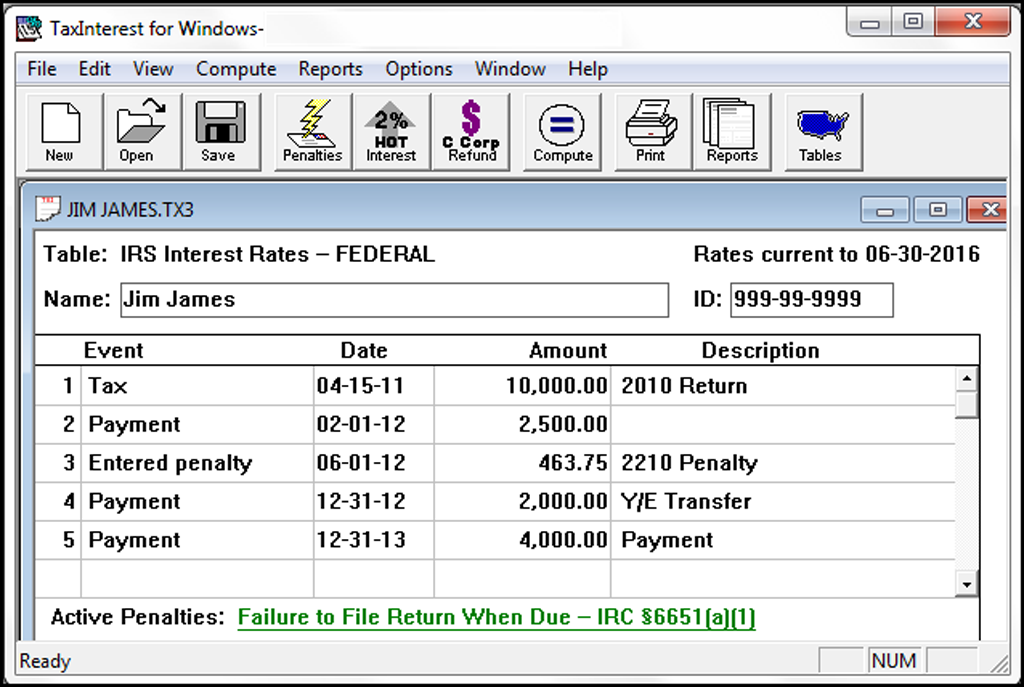

TaxInterest is the standard that helps you calculate the correct amounts. Use this tool to. See how your refund take-home pay or tax due are affected by withholding amount.

If youre still waiting for a refund it generally will be accruing interest and the rate jumps to 5 on July 1 according to the IRS. This IRS overpayment interest calculator can be used by tax attorneys accountants or CPAs and individuals or businesses to provide estimates of IRS interest on. Loans are offered in amounts of 250 500 750 1250 or 3500.

Interest is computed to the nearest full percentage point of the Federal short term rate for that calendar quarter plus. Thus the combined penalty is 5 45 late filing and 05 late payment per month. Ad Try Our Free And Simple Tax Refund Calculator.

For help with interest. And is based on the tax brackets of 2021. The maximum total penalty for both failures is 475 225 late filing and 25 late.

Estimate your federal income tax withholding. How It Works. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Many individual taxpayers whose 2019 tax returns show refunds will receive interest from the IRS.

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Irs State Interest Calculator Tax Software Information

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Does The Irs Pay Interest

Taxinterest Irs Interest And Penalty Software Timevalue Software

N0ftc5m10 Crgm

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Here S The Average Irs Tax Refund Amount By State

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Tax Return Calculator How Much Will You Get Back In Taxes Tips

Tax Preparation The 5 Irs Forms You Need 2019 Checklist Gobankingrates

Irs Tax Refund 2022 Why Do You Owe Taxes This Year Marca

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Easiest Irs Interest Calculator With Monthly Calculation

Tax Calculator Estimate Your Income Tax For 2022 Free